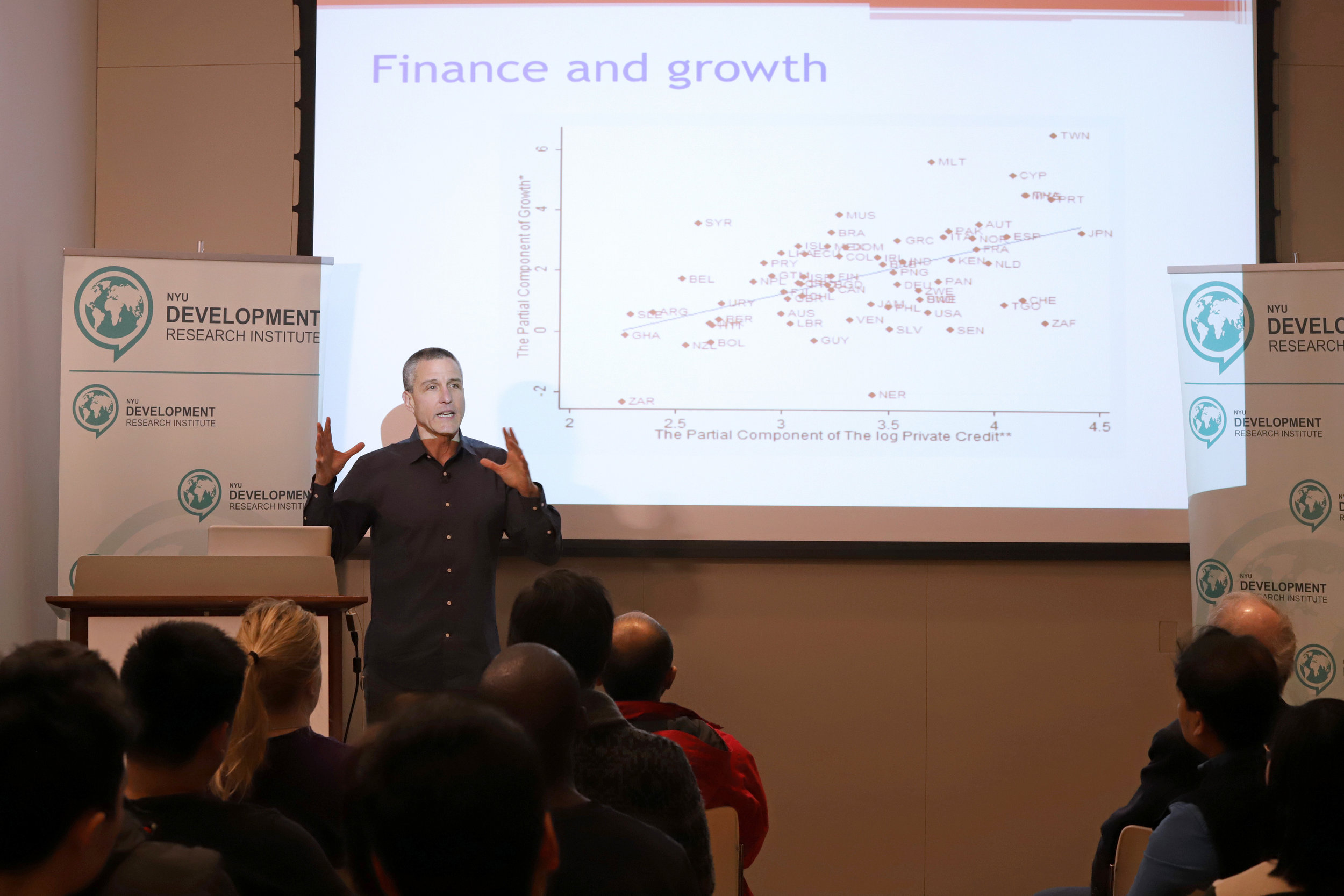

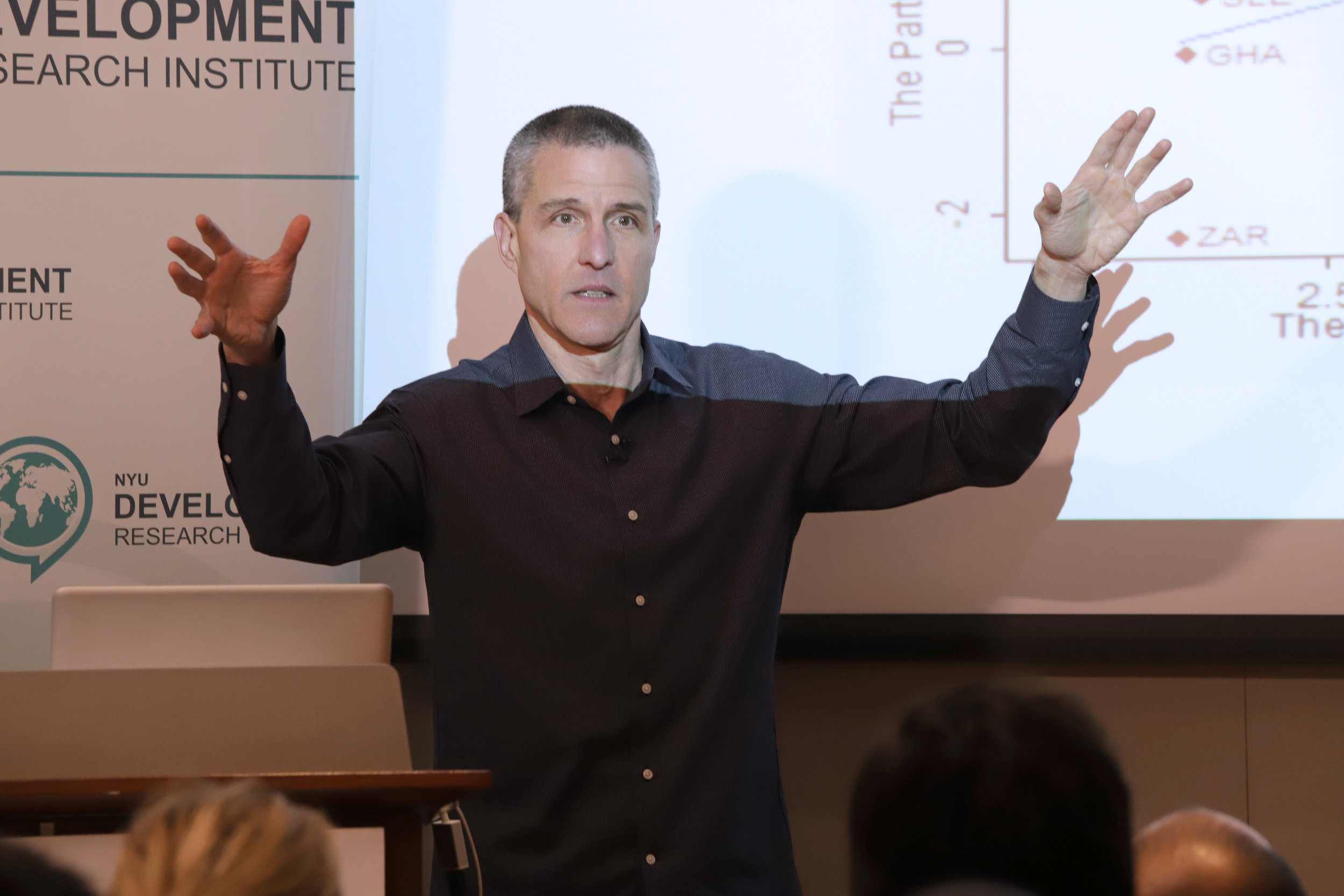

NYU DRI Talk – Ross Levine, “In Defense of Wall Street”

Images from the event.

On March 28th, 2018, NYU Development Research Institute and Africa House presented a lecture by Ross Levine of the University of California, Berkeley. Ross Levine discussed the importance of financial systems, particularly as it relates to poverty and inequality. By exploiting variation in the timing of bank deregulations in the United States, Levine illustrated the impact of financial policies and provided evidence to counter the stereotypes of finance often portrayed in the media.

Many agree with the second President of the United States: “… banks have done more harm to the morality, tranquility, and even wealth of this nation than they have done or ever will do good.” This certainly accords with the tenets of the Hollywood blockbusters, The Wolf of Wall Street and Wall Street. In this talk, I take a step back from the rhetoric and ask (a) what does the evidence say about the role of the financial system in shaping economic growth, poverty, income inequality, and discrimination and (b) what types of financial policy reforms will foster economic prosperity.

Speaker Bio:

Ross Levine is the Willis H. Booth Chair in Banking and Finance at the Haas School of Business, University of California, Berkeley. He is also a Senior Fellow at the Milken Institute, a Research Associate at the National Bureau of Economic Research, a member of the Council on Foreign Relations, and a member of the Scientific Advisory Council of the European Systemic Risk Board. He completed his undergraduate studies at Cornell University in 1982 and received his Ph.D. in economics from UCLA in 1987. He worked at the Board of Governors of the Federal Reserve System and the World Bank, where he conducted and managed research and operational programs. His work focuses on how financial sector policies and the operation of financial systems shape economic growth, entrepreneurship, and economic prosperity. His two most recent books, Rethinking Bank Regulation: Till Angels Govern and Guardians of Finance: Making Regulators Work for Us, stress that regulatory policies often stymie competition and encourage excessive risk-taking, with deleterious effects on living standards. Levine advises governments, central banks, regulatory agencies, and multilateral organizations. Read more.

Video from the event.